Evaluating Whether Afterpay Use Can Impact Your Credit History

As the appeal of Afterpay proceeds to rise, lots of individuals are left questioning about the prospective influence this service might have on their credit score scores. The relationship between Afterpay usage and credit ratings is a subject of passion for those aiming to keep or improve their economic health.

Comprehending Afterpay's Impact on Debt Ratings

While Afterpay does not execute credit checks when clients initially authorize up, late or missed repayments can still impact debt scores. When a consumer misses a settlement, Afterpay may report this to credit rating bureaus, leading to an adverse mark on the individual's debt record. Keeping an eye on payment due dates, preserving an excellent payment history, and ensuring all installments are paid on time are essential steps in protecting one's credit report rating when utilizing Afterpay.

Variables That Influence Credit Rating Modifications

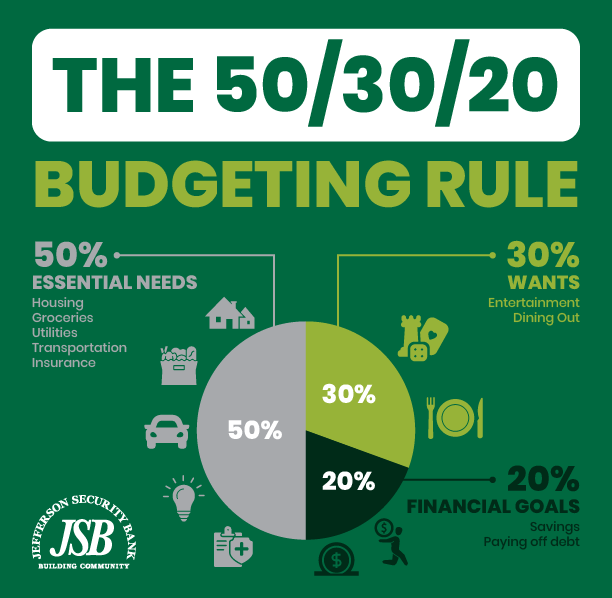

Comprehending Afterpay's effect on credit rating exposes a straight web link to the various elements that can substantially affect adjustments in a person's credit rating score gradually. One critical factor is payment history, representing regarding 35% of a credit rating. Making on-time payments regularly, consisting of those for Afterpay acquisitions, can positively affect the credit report rating. Credit utilization, which makes up approximately 30% of ball game, is another important element. Using Afterpay responsibly without maxing out the available credit scores can help maintain a healthy and balanced credit rating usage ratio. The length of credit rating, adding around 15% to the score, is also important. Using Afterpay over a prolonged duration can positively impact this facet. In addition, new credit report queries and the mix of charge account can influence credit history. does afterpay affect credit score. Although Afterpay might not straight impact these variables, comprehending their significance can aid people make informed choices to preserve or boost their credit rating ratings while utilizing solutions like Afterpay.

Surveillance Credit Score Score Modifications With Afterpay

Keeping an eye on credit history rating modifications with Afterpay entails tracking the impact of repayment habits and credit report utilization on general credit wellness. Utilizing Afterpay for little, convenient purchases and keeping credit card balances low loved one to credit rating limitations shows accountable credit scores habits and can positively affect credit history scores. By remaining proactive and alert in monitoring repayment behaviors and credit scores use, people can successfully handle their debt rating while making use of Afterpay as a settlement alternative.

Tips to Handle Afterpay Properly

To browse Afterpay sensibly and preserve a healthy credit report score, individuals can apply effective methods to manage their financial commitments carefully. In addition, keeping track of Afterpay payment schedules and ensuring prompt payments can help stay clear of late fees and negative see here impacts on credit rating scores. By complying with these suggestions, people can leverage Afterpay sensibly while safeguarding their debt rating and financial well-being.

Final thought: Afterpay's Function in Credit report Health And Wellness

In evaluating Afterpay's effect on credit health, it comes to be obvious that sensible financial management remains extremely important for people using this service. While Afterpay itself does not directly influence credit report, neglecting settlements can lead to late charges and debt build-up, which can indirectly impact creditworthiness - does afterpay affect credit score. It is crucial for Afterpay users to budget plan efficiently and guarantee timely payments to copyright a positive credit rating standing

Additionally, recognizing exactly how Afterpay incorporates with personal money this post routines is crucial. By utilizing Afterpay responsibly, people can delight in the ease of staggered settlements without threatening their credit scores health. Monitoring costs, examining cost, and staying within budget are essential techniques to avoid monetary stress and possible credit report ramifications.

Conclusion

Recognizing Afterpay's influence on credit score ratings discloses a direct link to the various factors that can substantially influence modifications in an individual's credit scores rating over time. In addition, new credit inquiries and the mix of credit scores accounts can you could try this out influence credit score ratings.Keeping track of credit report rating adjustments with Afterpay involves tracking the effect of repayment behaviors and credit rating usage on total credit scores health and wellness - does afterpay affect credit score. Utilizing Afterpay for tiny, workable purchases and maintaining credit card equilibriums low relative to credit report restrictions demonstrates liable credit score behavior and can positively influence debt scores. By staying vigilant and aggressive in keeping an eye on repayment practices and credit rating utilization, individuals can efficiently manage their credit history rating while using Afterpay as a repayment alternative